Home/ Windows10/ How to establish SBI Credit Card Transaction Limit in Windows10 and also Android

In Sept 2020, RBI released standards to charge card as well as debit cards to stop fraudulence as well as protection gaps. You can opt-in or opt-out for every classification of purchase and also

established Spend restrictions.

According to the brand-new standards, card customers will certainly currently have the ability to sign up choices (opt-in or opt-out of solutions, invest restrictions, and so on) for worldwide deals, on the internet purchases along with contactless card purchases.

https://www.financialexpress.com/money/rbis-new-credit-and-debit-card-rules-to-be-effective-from-1st-october-2020- check-details/2094379/

This uses to SBI credit scores cards. Prior To Oct 1st

,2020, there are default restrictions for your residential as well as worldwide purchases. Making Use Of Windows10 as well as Chrome, you can establish the invest limitation for each and every classification kind. You additionally see that sharp or alert in your SBI charge card control panel.

How to Set Transaction Limit on your SBI Credit Card

)

Time Needed: 3 mins.

Steps to handle your SBI bank card use for residential and also on-line purchases in India.

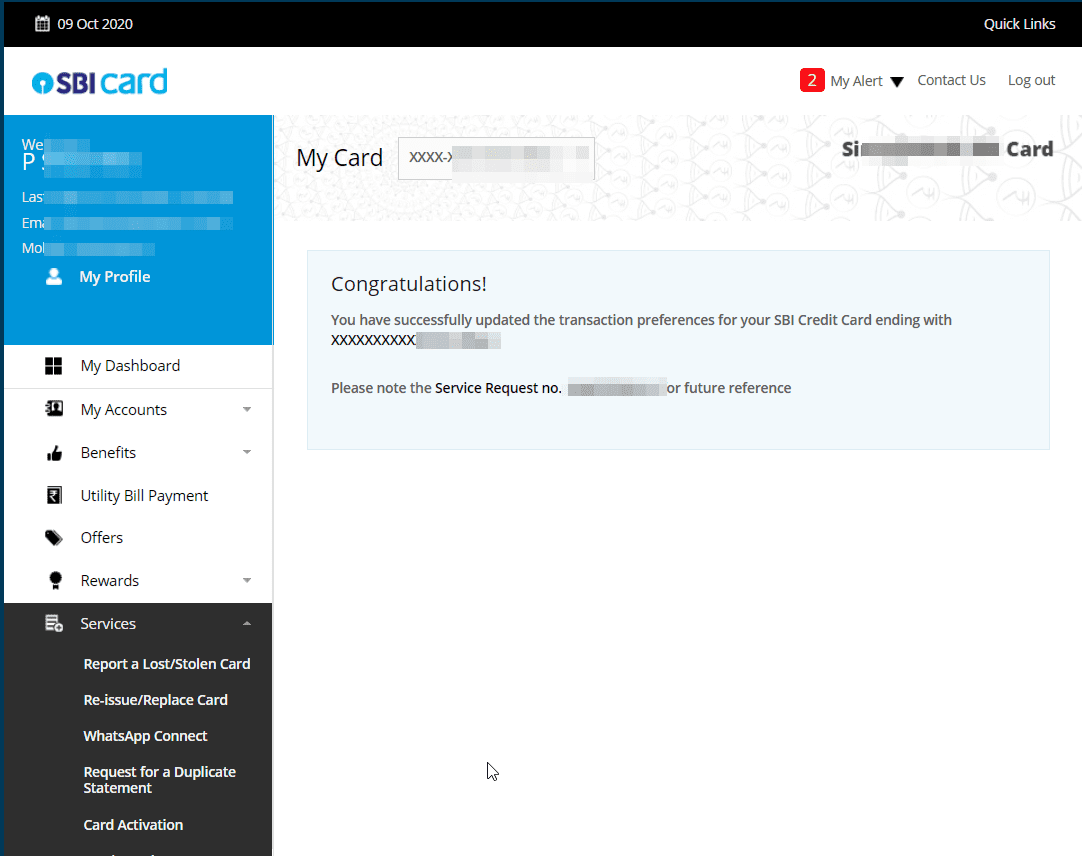

- Login to your SBI Credit Card account– https://www.sbicard.com/

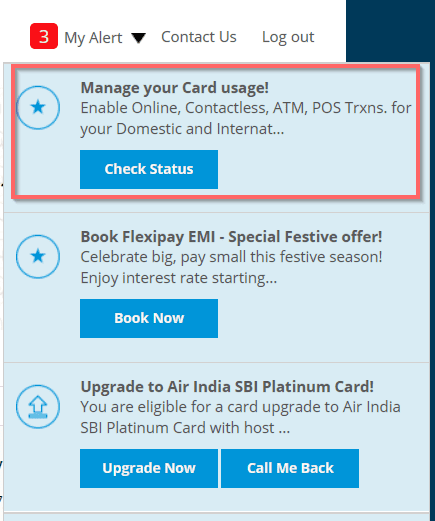

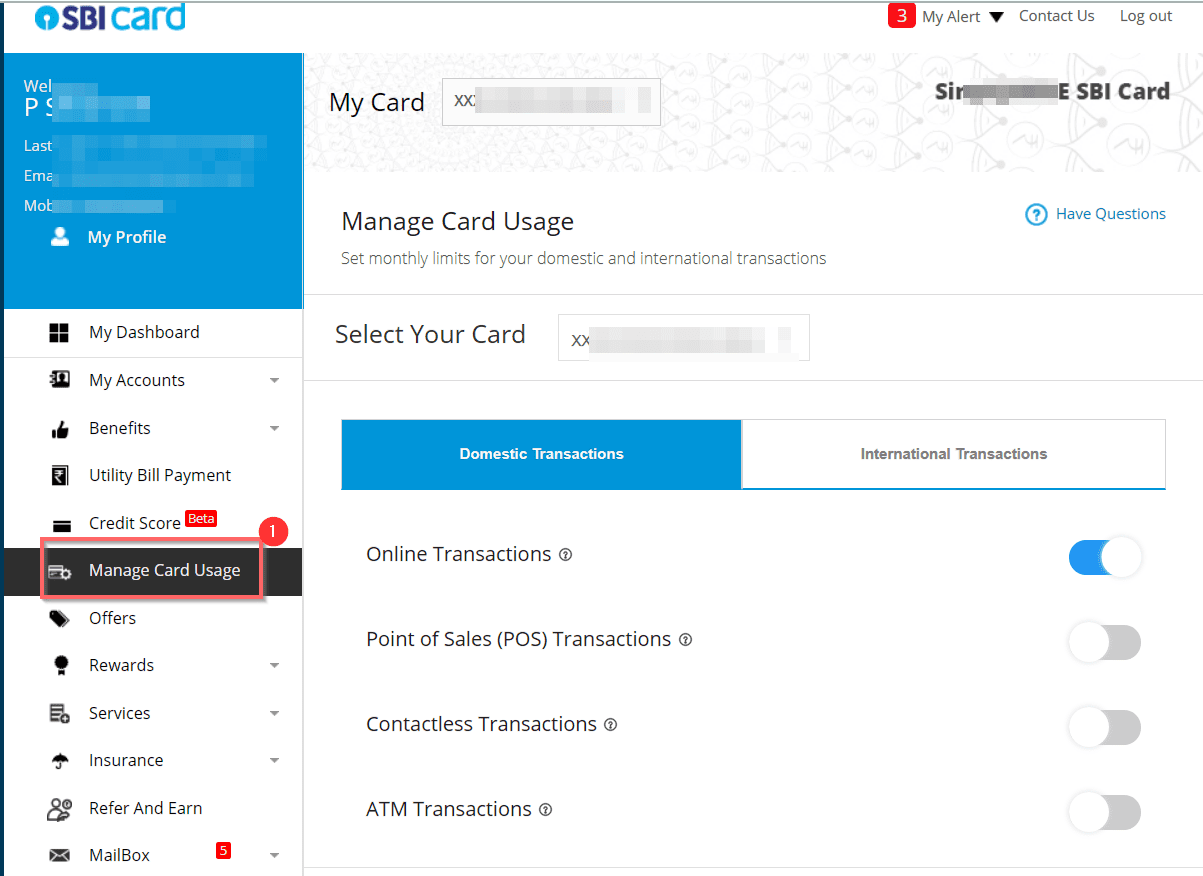

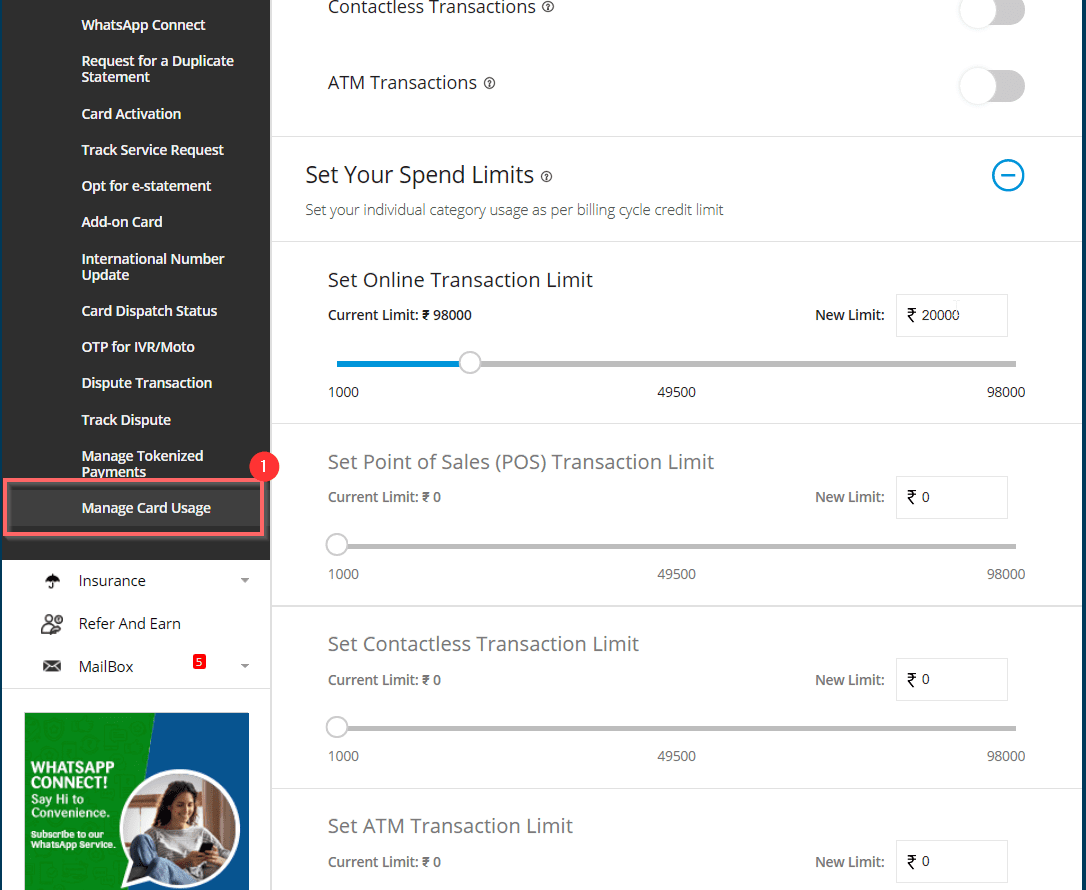

- Below “My Dashboard”, click” Manage Card Usage”.

- On the right-hand side,” Select your Card”.

If you have just one, it is instantly picked. Or else, you need to choose the card for which you wish to alter.

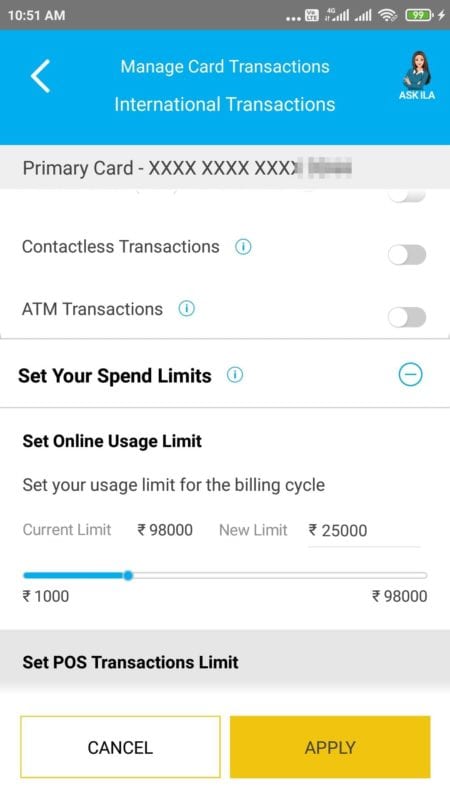

- There are 2 tabs– 1. Residential Transactions 2. International

Transactions

You can disable or allow the list below kinds.Online Transactions

Point of Sales( PoS) Transactions

Contactless Transactions

ATM Transactions

Opt-InTo opt-in or make it possible for a specific kind of deal, you can relocate the slider to the. This will certainly make it blue.

-

Opt-out

To opt-out, you can relocate left and also will certainly look grey.

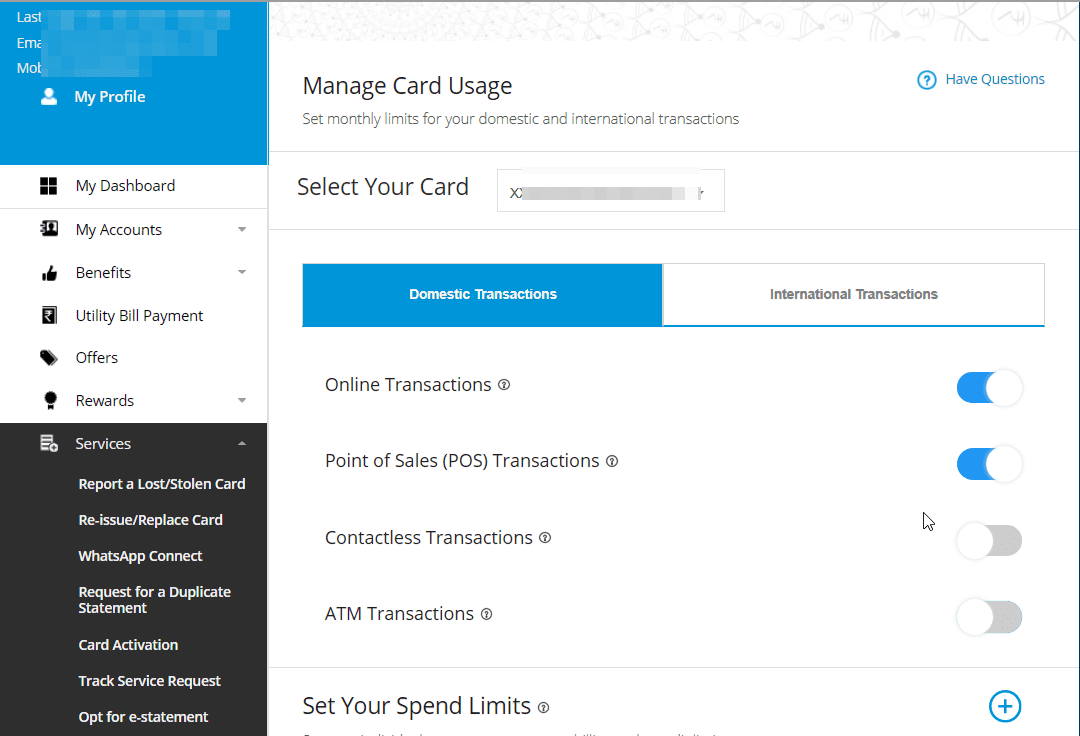

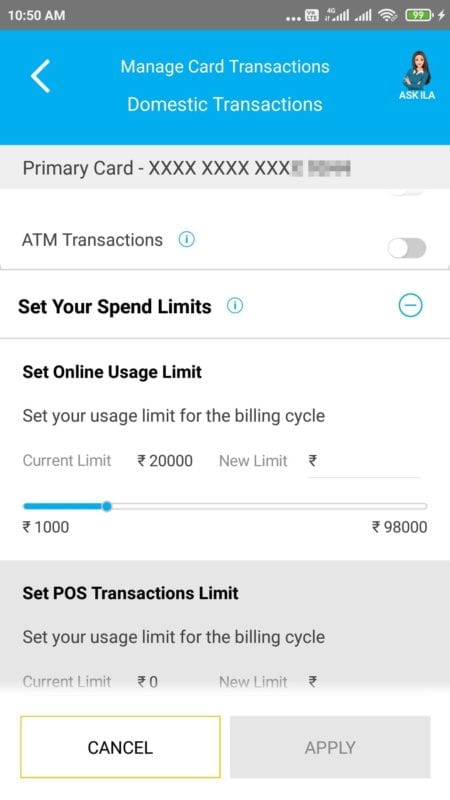

- For each classification, you can establish the invest restriction.

Set Online Transaction Limit

Point of Sales( PoS) Transaction Limit

Set Contactless Transaction restriction

Set ATM Transaction restriction

- Example

For each of the above kinds, the existing deal restriction is revealed. In my instance it was Rs98000 You can establish the brand-new restriction by getting in the number in the message box. In this situation, I have actually established the restriction to Rs20000

.

How to Enable/Disable Transaction Category and also Set Transaction Limit in SBI Card App– Android

Just as you can transform on/off the deal enter the internet user interface, you can do the exact same in Android. You require to mount the SBI Card application from Google Play Store– https://play.google.com/store/apps/details?id=com.ge.capital.konysbiapp&hl=en

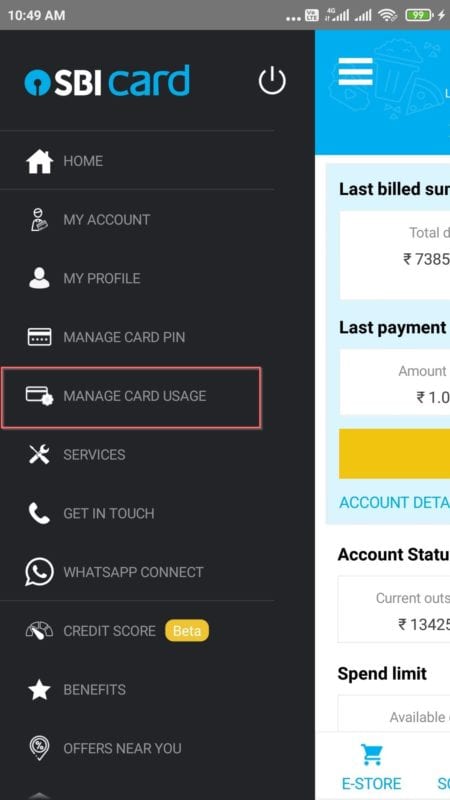

- Open the SBI Card App on Android.

- Login to the application, making use of MPIN or Fingerprint– This relies on the qualifications you have actually offered throughout installment of the application.

- Tap the 3 straight lines on top left hand side.

- Tap the” Manage Card Usage“.

)

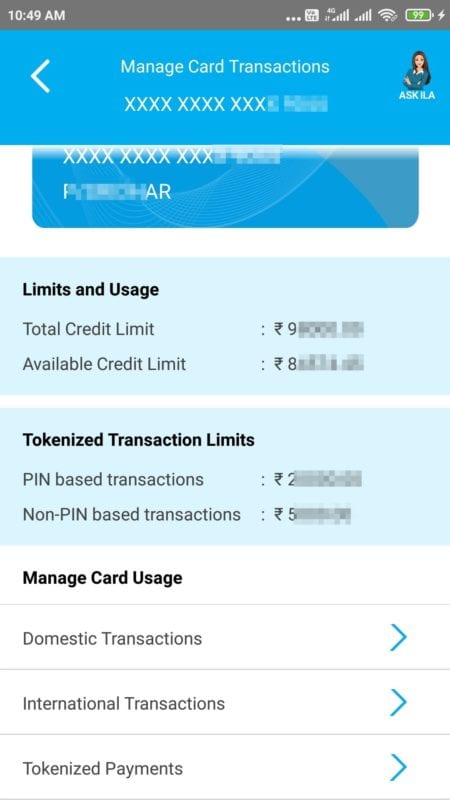

- On the following display, the complying with points show up.

- Limits as well as Usage

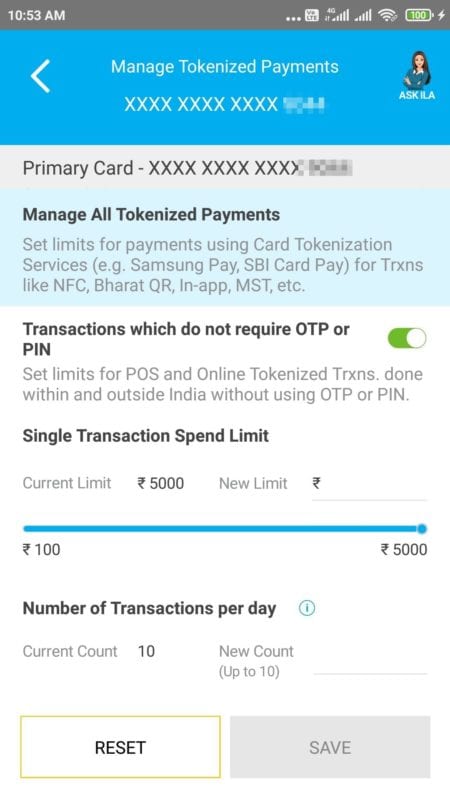

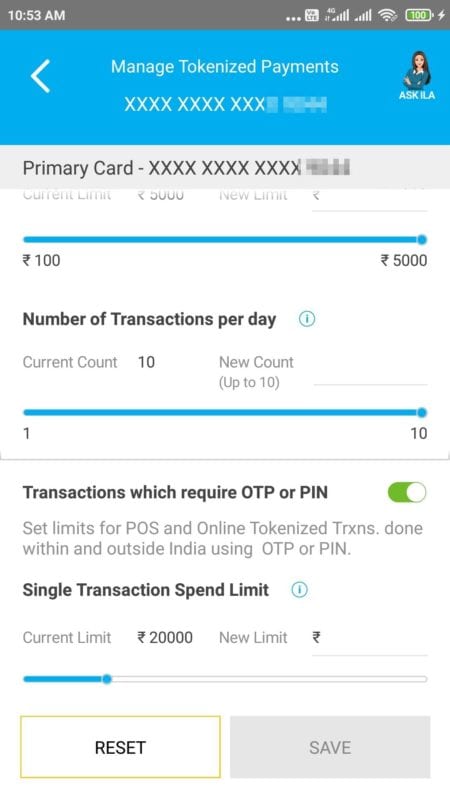

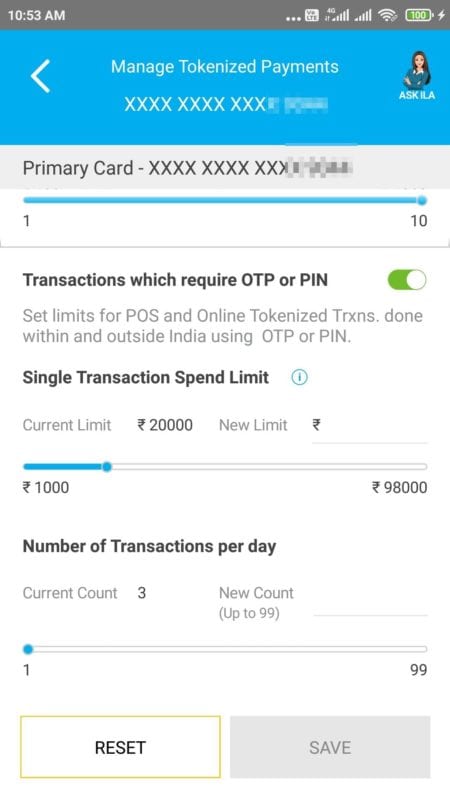

- Tokenized Transaction Limits

- For” Limits and also Usage“, you can see the” Total Credit Limit” and also”

Available Credit Limit“. - For Tokenized Transaction Limits, you can see the quantity restrictions for” PIN based Transactions” as well as”

NON-PIN based Transactions“. - Below that, you can see” Manage Card Usage“.

- The complying with things are readily available.

- Domestic Transactions

- International Transactions

- Tokenized Payments

-

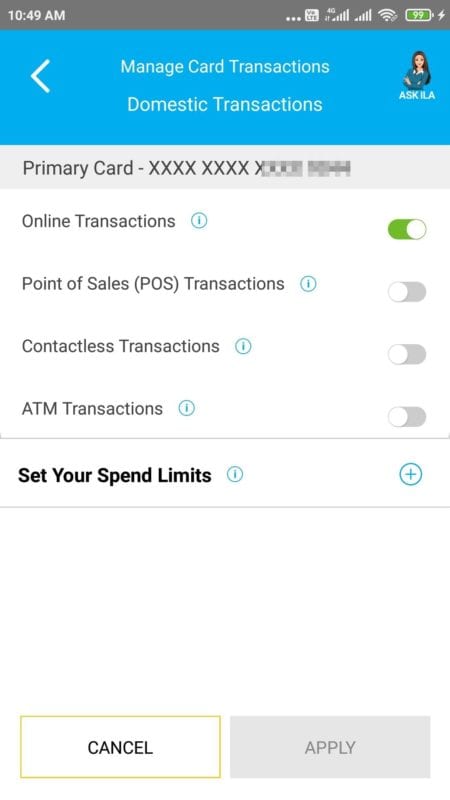

- Tap on Domestic Transaction for more alternatives.

- The adhering to kind of purchase kinds can be made it possible for or disabled on your SBI Credit card.

-

) Online Transactions

- Point of Sales( POS) Transactions

- Contactless Transactions

- ATM Transactions

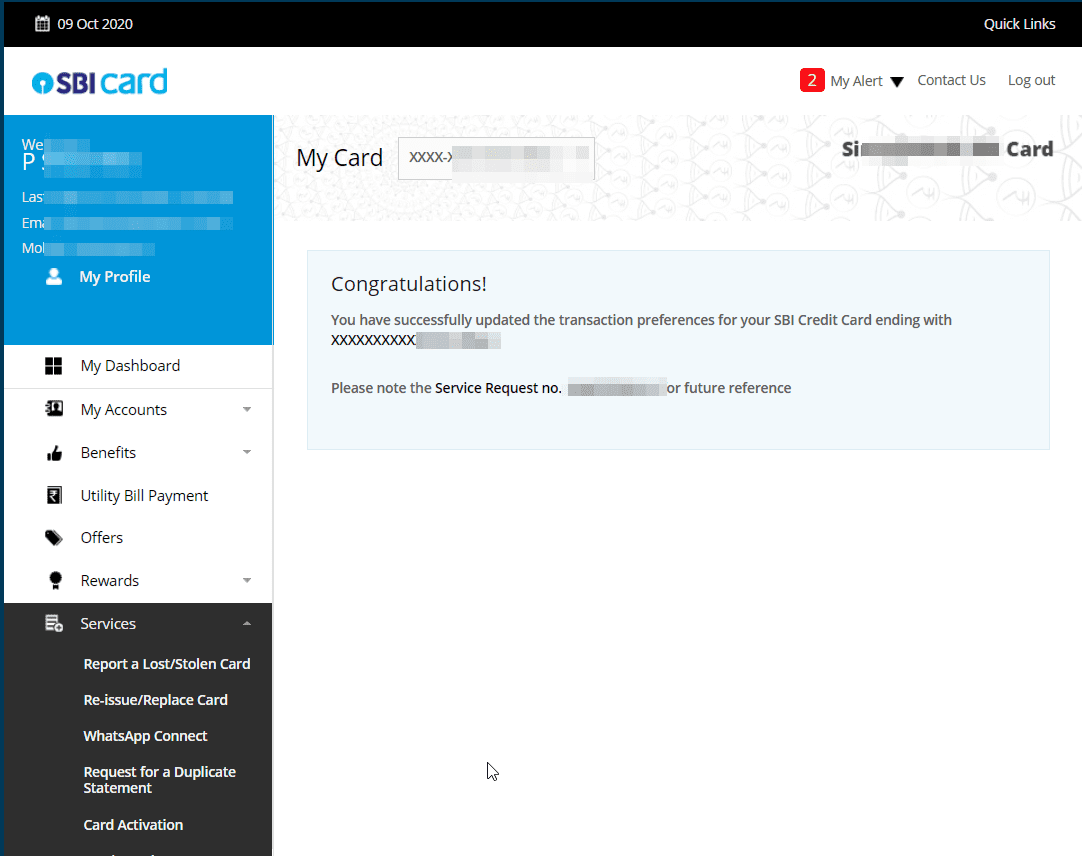

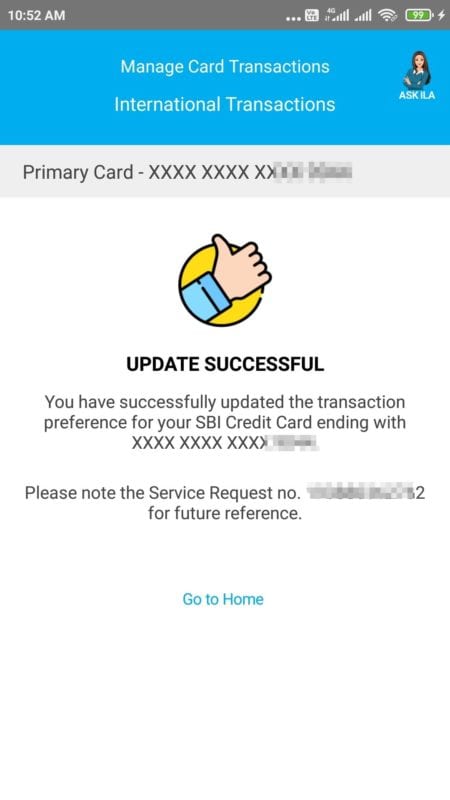

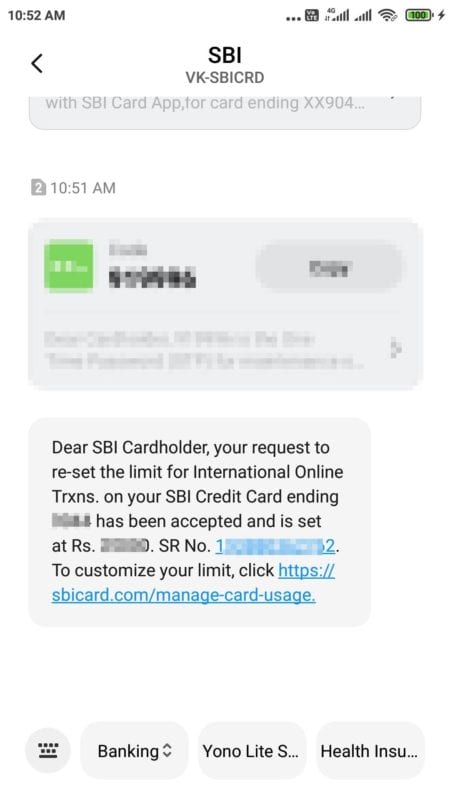

with a Service Request Number

SMS message to your signed up mobile number with SR Number

- Transactions which do not need OTP or PIN

- Txns which call for OTP or PIN

Save

Which Category of SBI Credit Card Transaction Type to Enable or Disable

In the majority of situations, if you are

utilizing a bank card for on-line deals, after that you can opt-in for that function. Usually, to obtain a discount rate on Amazon, FlipKart, BigBasket and also various other on-line solutions you will certainly be utilizing your SBI bank card. Because situation, you can maintain the alternative of Online Transactions open.

If you do a great deal of buying in retailers, after that you can possibly utilize the old style of “PoS” technique of deal. Utilizing this classification, you require to swipe the bank card. You have to go into a PIN. If you favor to pay by means of Google Pay, PhonePe, PayTM, you can opt-out of this deal kind.

SBI charge card have actually additionally provided contactless settlements in2020 The card gets the radio signals or utilizes RFID modern technology. Purchases in close physical closeness. Quick and also for tiny settlements. To enhance protection, you can opt-out of this purchase kind.

The regular use of cards to take out cash money is making use of ATM cards. A tiny cost subtracted when you utilize SBI bank card for this function. This works when out-of-cash. To stop fraudulence or shed or swiped cards, you can disable this kind.